The Emergence of Accidental Reading Landlords in a Slowing Housing Market?

A Reading landlord remarked to me the other day that he felt that there were more 'posher' up-market properties coming up for rent in the last six months compared to a couple of years ago.

I stated that this was the case, and it wasn't all down to the recent rental growth – it was the growth of the upmarket 'accidental landlord'.

With the Reading housing market showing signs of a slowdown and predictions of further house price declines, I am starting to see the return of the ‘accidental landlord’, but in a somewhat different form to what they were in 2008/9.

An ‘accidental landlord’ becomes a landlord unexpectedly or unintentionally. This often occurs when homeowners rent out their property instead of selling it due to a slowing housing market, a change in personal circumstances, or other unforeseen reasons.

While the sales market in Reading has experienced a period of strength in recent years, activity has started to slow down from the levels seen in 2021/2. In contrast, there has been soaring demand for Reading rental properties.

To give you an idea of the growth of rents.

The average rent for homes coming on the market in the Reading area in 2021 was £1,232 per month, whilst in 2023, it has been £1,403 per month.

Some Reading homeowners, fearing not achieving their desired selling price, might opt to retain ownership of their properties and instead rent them out until market conditions improve.

Back in 2008/9, this trend was particularly evident in the middle market segment.

However, in 2023, many property commentators are suggesting if ‘accidental landlords’ do start to emerge, it will be in the upper quartile property segment (i.e., the top 25% of properties by value), where many homeowners bought in the post Lockdown race for space of 2021/2.

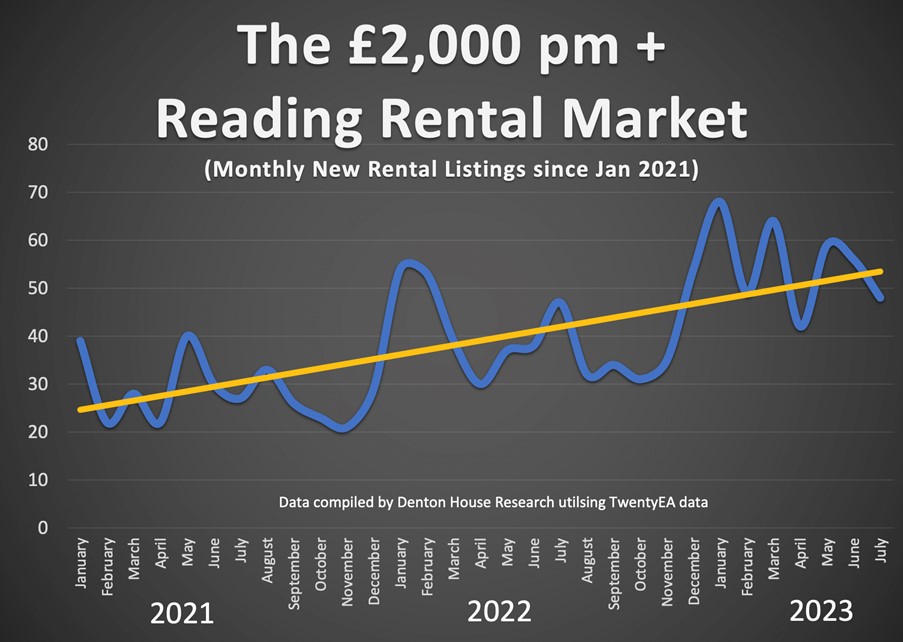

Looking at the figures, they could be correct.

The upper quartile rental market (excluding student lets) starts in just under the £2,000 per month range in Reading.

- In the first seven months of 2021 (Jan to Jul) in the Reading area – an average of 30 properties a month came onto the market for rent at £2,000 per month or more.

- In the first seven months of 2022 (Jan to Jul) in the Reading area - an average of 43 properties a month came onto the market for rent at £2,000 per month or more.

- In the first seven months of 2023 (Jan to Jul) in the Reading area - an average of 55 properties a month came onto the market for rent at £2,000 per month or more.

(Reading area being RG1/2/4).

Many of these could afford to be patient in pursuit of optimal selling conditions. The rise of ‘accidental landlords’ can be attributed to various factors, such as limited property appreciation, increasing mortgage costs, and robust demand for Reading rentals, making renting out properties an attractive alternative.

‘Accidental landlords’ are also created through other diverse circumstances.

Irrespective of what is happening in the economy and Reading property market, births, deaths and marriages continue. There will always be some new couples who decide to rent out one of their properties after moving into a shared home, while others inherit properties through the passing of parents or grandparents.

The current average tenancy length of 51 months provides these new Reading landlords with just over four years to allow Reading property values to recover before re-evaluating the market. However, stepping into the role of an accidental landlord carries specific implications that homeowners need to be mindful of.

Understanding the tax implications is a crucial aspect that ‘accidental landlords’ should grasp.

Transitioning to landlord status may result in the loss of specific tax benefits, including stamp duty relief, and necessitate payment of income tax on rent. Furthermore, upon selling the Reading rental property, landlords may become liable for capital gains tax on the profit made from the sale, as it is no longer considered their primary residence and I implore you to take advice from an accountant.

To mitigate the impact of tax changes, some Reading landlords have chosen to incorporate their properties into Limited Companies. Corporate structures offer potential tax relief on mortgage costs and the opportunity to pay lower Corporation Tax rates than individual income tax rates. However, incorporating properties involves additional expenses, such as stamp duty and capital gains tax on existing properties transferred to the company.

Individual landlords with only one property may find incorporation less advantageous, but it could be a viable option for those planning to expand their buy-to-let portfolios.

Investing in property maintenance is a crucial consideration for Reading's 'accidental landlords'.

Well-maintained properties are more likely to retain or increase their value over time. Retrofitting properties to improve energy performance can also benefit tenants and future buyers, helping reduce utility costs and enhance overall comfort.

Accidental landlords must diligently handle this critical area: appropriately protecting tenants' deposits. Please safeguard deposits adequately to avoid significant compensation claims, with landlords potentially losing up to three times the deposit amount. To protect against such risks, landlords must ensure compliance with deposit protection schemes and provide tenants with essential documents, including Energy Performance Certificates, the Government's "How to Rent" guide, and current gas safety certificates.

Misunderstandings can inadvertently arise to renting direct to family or friends, leading to legal disputes.

Even though you know the tenant, it still could be wise to employ the services of a letting agent to establish clear terms in writing at the outset of a tenancy to avoid potential conflicts and protect the rights of both landlords and tenants. This becomes particularly relevant as the Renters Reform Bill, set to introduce significant changes to the private rental sector, including tenancy length and the process of regaining possession, is awaiting approval.

My overriding message to every Reading ‘accidental landlord’ is that they must be aware of the tax implications, consider incorporation a potential strategy, invest in property maintenance, protect tenants' deposits, and establish clear terms to avoid disputes. Additionally, there are over 170 pieces of regulations regarding renting your property out. Also, it's essential to stay informed about forthcoming changes in renters' rights introduced by the Renters Reform Bill.

In conclusion, with the Reading housing market experiencing a slowdown, I suspect an increasing number of Reading homeowners are considering becoming ‘accidental landlords’ by opting to rent out their properties instead of selling.

You must weigh the risks of renting your Reading home and the potential rewards.

I know of many stories of Reading homeowners who waited five or six years after the Credit Crunch to hit their ‘target price’ for their existing home, only to realise it cost them tens of thousands of pounds in costs and the price they had to pay for their new home. On the other side of the coin, I know plenty of ‘accidental landlords’ in Reading who used the fact that they became an ‘accidental landlord’ as an opportunity to build an impressive rental portfolio over the last 15 years.

If you are uncertain or do not possess all the facts, don't hesitate to contact me to discuss your plans. Then I can give you appropriate level-headed advice to make the right decision. By taking proactive steps and understanding the risk and rewards of being an ‘accidental landlord’ in Reading, you can navigate the Reading property market successfully, even during uncertain times in the housing market.

Require a Conveyancing Solicitor?

For an even smoother moving experience, we can introduce you to our network of trusted conveyancing solicitors. For a no-obligation introduction and Bespoke conveyancing quote, click below.

Bespoke ConveyancingRead What Our

Customers Say

Discover the true value of your property with the top estate agents in Reading.

Unlock the potential of your property with a CONFIDENTIAL, FREE, NO-OBLIGATION valuation and marketing consultation from Reading’s top estate agents. Our experienced property experts provide an accurate assessment tailored to current market trends, ensuring you’re informed and confident in your next steps. Don’t just wonder—discover what your property is truly worth with a trusted team dedicated to helping you maximize value

Book a Valuation