Reading Property Market Update – Q1 2025 Trends & Insights

Understanding what’s really going on in the Reading property market is key to cutting through the noise and seeing the true picture—both locally and nationally.

Despite near-constant doom-and-gloom headlines predicting a housing crash since September 2022, the stats tell a very different story. The British property market—and Reading in particular—is holding up remarkably well.

National Property Trends in Q1 2025

Let’s start with the lifeblood of the housing market—new properties coming on to the market.

-

444,742 UK properties were listed in Q1 2025 (January, February, and March).

-

This compares with 444,668 in Q1 2024 and 407,946 in Q1 2023.

That consistency suggests the market remains strong despite economic headwinds. Compare that to 2008, when new listings surged, flooding the market and causing prices to fall. In today’s market, that’s not the case.

Want to understand your home’s current market position? Get your instant online valuation here: Bespoke Estate Agents - Bespoke Estate Agents

How to Read the Local Market Pulse

Here’s a quick DIY method to assess how hot (or cool) the local Reading property market is:

-

Go to Rightmove and search for properties currently for sale in Reading.

-

Make a note of the total number.

-

Then repeat the search, this time including properties marked as ‘sold subject to contract’ (SSTC).

-

Compare the two numbers

That ratio tells you how much demand there is right now. Climbing ratio = confidence is returning. Falling = demand might be softening.

You can take this further by breaking the data down by area either by Postcode (RG1, RG30, RG2, RG4, RG5, RG6) by area, Earley, Arborfield, Shinfield, Lower Earley, Tilehurst etc or property type (e.g. detached, terraced, flats).

What’s Selling – By Price Band (UK Overview)

Nationally, 308,258 properties sold SSTC in Q1 2025. That’s up from:

-

289,178 in Q1 2024

-

276,482 in Q1 2023

Here’s how those sales compare to what was listed:

| Price Band | % of Listings | % of Sales |

|---|---|---|

| Up to £250k | 34.6% | 40.6% |

| £250k–£500k | 41.2% | 41.1% |

| £500k–£750k | 13.7% | 11.3% |

| £750k–£1m | 5.3% | 3.9% |

| £1m+ | 5.2% | 3.1% |

This shows stronger demand in the lower to mid-market range, with upper price bands seeing less traction.

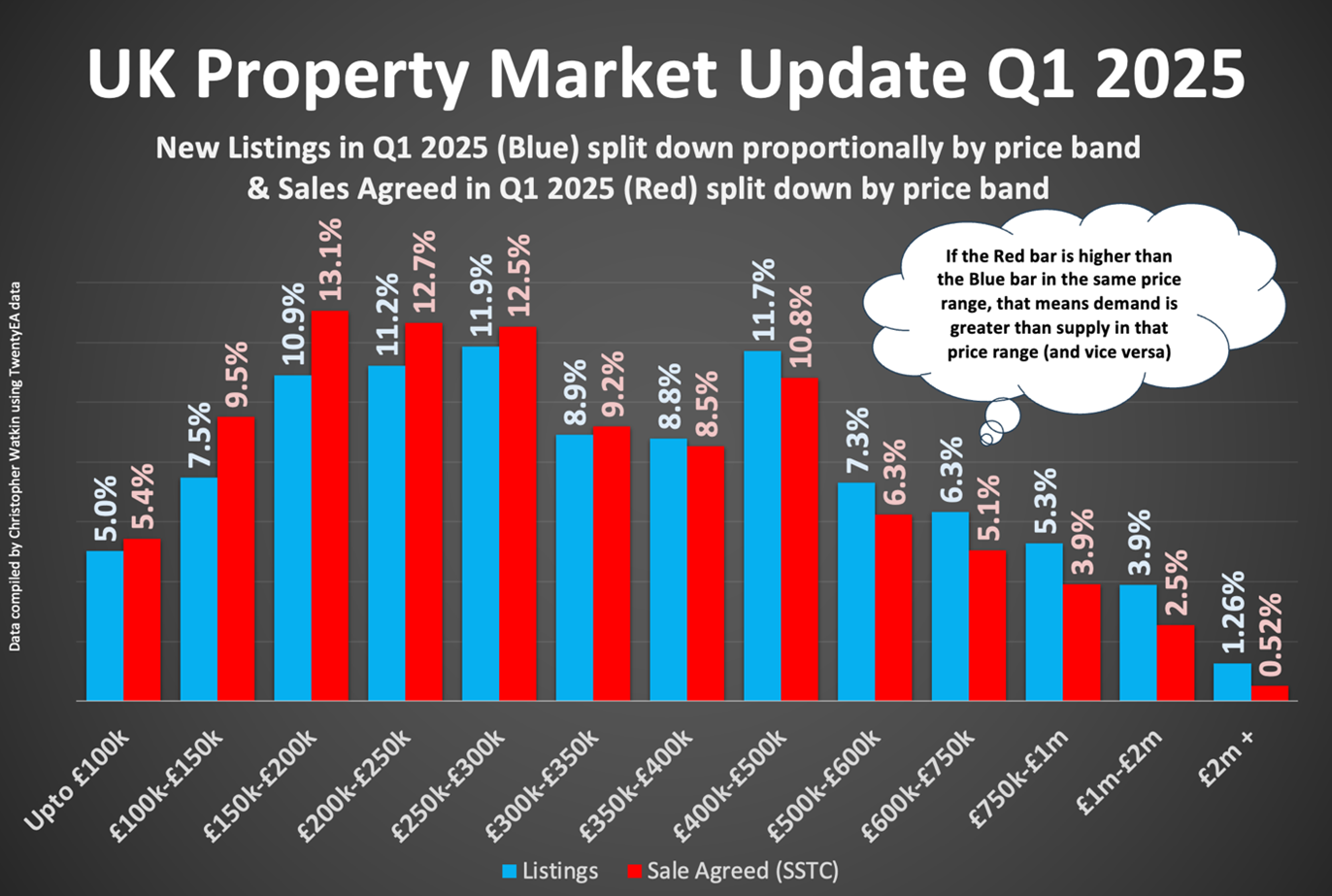

What’s Selling – Visual Breakdown by Price Band

The chart below breaks down new listings (blue) and sales agreed (red) in Q1 2025, across all price bands in the UK:

If the red bar is higher than the blue bar in a price range, demand exceeds supply in that band—making it a seller’s market. The reverse is also true.

This makes it easy to see how homes priced under £250k are outperforming the rest of the market in terms of buyer demand, while properties above £750k are seeing significantly lower conversion rates from listing to sale agreed.

What’s Happening in the Reading Property Market?

Let’s zoom into our patch, Reading

-

Properties Coming to Market in Reading:

-

1,194 listings in Q1 2025

-

Average asking price: £433,768

-

Most popular price band: £400k–£500k (179 listings), followed by £250k–£300k (156 listings)

Properties Sold in Reading:

-

847 properties sold SSTC in Q1

-

Average sale price: £437,724

-

Most popular sales band: £400k–£500k (141 sold), then £350k–£400k (102 sold)

-

Price Reductions – Still a Key Theme

Here’s how many sellers had to drop their price to secure a deal:

-

Q1 2025: 224,750 reductions across 698,006 listings

-

Q1 2024: 198,682 on 633,417 listings

-

Q1 2023: 243,602 on 590,481 listings

-

Q1 2022: 119,068 on 424,796 listings

This shows many are still overpricing initially and having to adjust—usually after missing their key window of buyer attention.

What This Means for Reading Sellers and Buyers

If you’re selling in Reading, here’s what to know:

Start with a realistic price

Overpricing at launch can damage interest. You’ll lose the vital honeymoon window—and a reduction later may prompt buyers to wonder what’s wrong.

There’s still strong buyer demand

But buyers are pickier and more price-sensitive. Homes that are well-presented and well-priced are still moving, especially in the £250k–£500k range.

Thinking of trading up?

With prices 15.1% cheaper in real terms (after inflation) than three years ago, now could be a smart time to move.

Not ready to sell?

Consider letting your home instead. Becoming a landlord can be a smart medium-term strategy in a changing market.

Final Thoughts

Yes, higher mortgage rates and economic uncertainty are still in the picture. But for many who were priced out during the bidding wars of 2021–2022, today’s calmer market offers a chance to move with more breathing room.

Whatever your plans, the best approach is to align your property decisions with your life plans, not just the headlines.

If you’re thinking of moving in 2025, or just want a no-pressure chat about your options, I’m always happy to pop round. No sales pitch—just facts and honest advice.

Let’s Talk

Whether you're ready to move now, later this year, or just exploring, I'm here to help you make informed choices.

You can book in an appointment for us to visit you, on a day and time to suit Request a Valuation | My Bespoke Agent Or just call me for a friendly chat—Mark Heneghan, Bespoke Estate Agents on 0118 967 0005

Require a Conveyancing Solicitor?

For an even smoother moving experience, we can introduce you to our network of trusted conveyancing solicitors. For a no-obligation introduction and Bespoke conveyancing quote, click below.

Bespoke ConveyancingRead What Our

Customers Say

Discover the true value of your property with the top estate agents in Reading.

Unlock the potential of your property with a CONFIDENTIAL, FREE, NO-OBLIGATION valuation and marketing consultation from Reading’s top estate agents. Our experienced property experts provide an accurate assessment tailored to current market trends, ensuring you’re informed and confident in your next steps. Don’t just wonder—discover what your property is truly worth with a trusted team dedicated to helping you maximize value

Book a Valuation